Introduction: What are payments?

People, businesses, and even governments exchange money to trade goods or services. This exchange is called a payment. Meanwhile, the stakeholders involved in facilitating these payments make up the payment industry.

Given that consumers make payments every day, the payment industry’s ability to process these transactions swiftly, securely, and at a global scale is critical for continued economic activity around the world. To ensure this, various stakeholders across the payments ecosystem have, over time, set standards for how these payments get processed.

Whilst these standards are largely the same around the world, there are some nuances within countries that stakeholders need to navigate.

In this article post, we take you through how payments are made, with a deep dive into how cards are used and processed as a payment instrument. We’ll also touch on how payments in Saudi Arabia are processed and how Stitch can help stakeholders build payment products.

How are payments made?

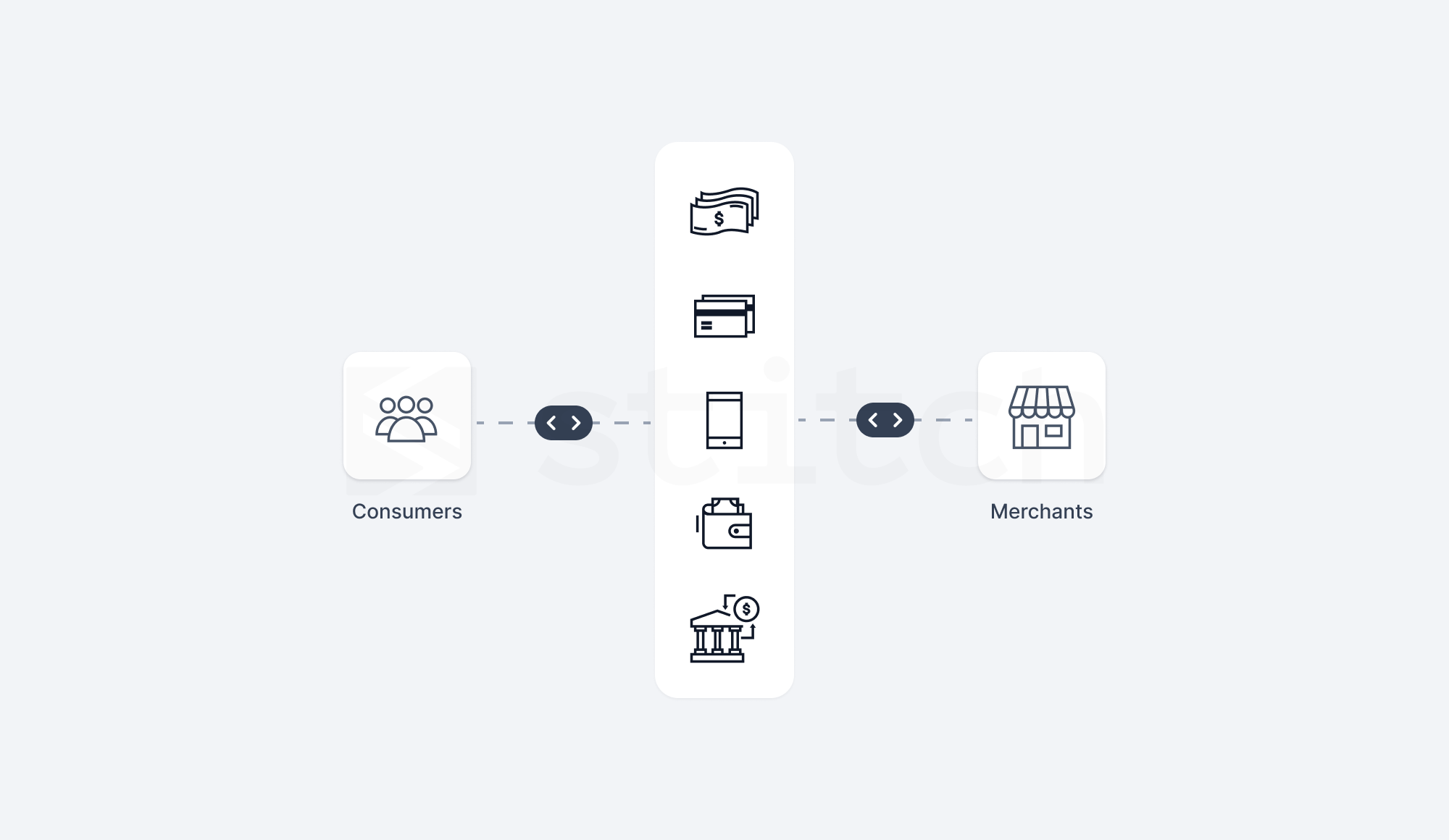

The payments industry allows consumers to initiate payments with merchants both online and at brick-and-mortar stores through several payment instruments. Here are some common ones:

a. Cash: Physical currency remains a fundamental form of payment, but it’s gradually decreasing as digital alternatives become more popular.

b. Payment Cards: Prepaid , debit , or credit cards , with magnetic stripes or chips allow consumers to make payments and access funds. These cards can either come in physical form as a plastic card or in virtual form on consumers’ smartphones.

c. Digital Wallets: Apps, like Apple Pay, Google Pay, and mada Pay , store consumers’ card information as tokenized cards .

d. Bank Transfers: Transfer of funds from one bank account to another over various methods including wire transfers over rails such as Sarie in Saudi Arabia (managed by Saudi Payments ) or international rails like SWIFT .

e. Bill Payment Networks: Payment of bills and other invoices through apps, including Sadad in Saudi Arabia (also managed by Saudi Payments ).

Who are the key players in the cards industry?

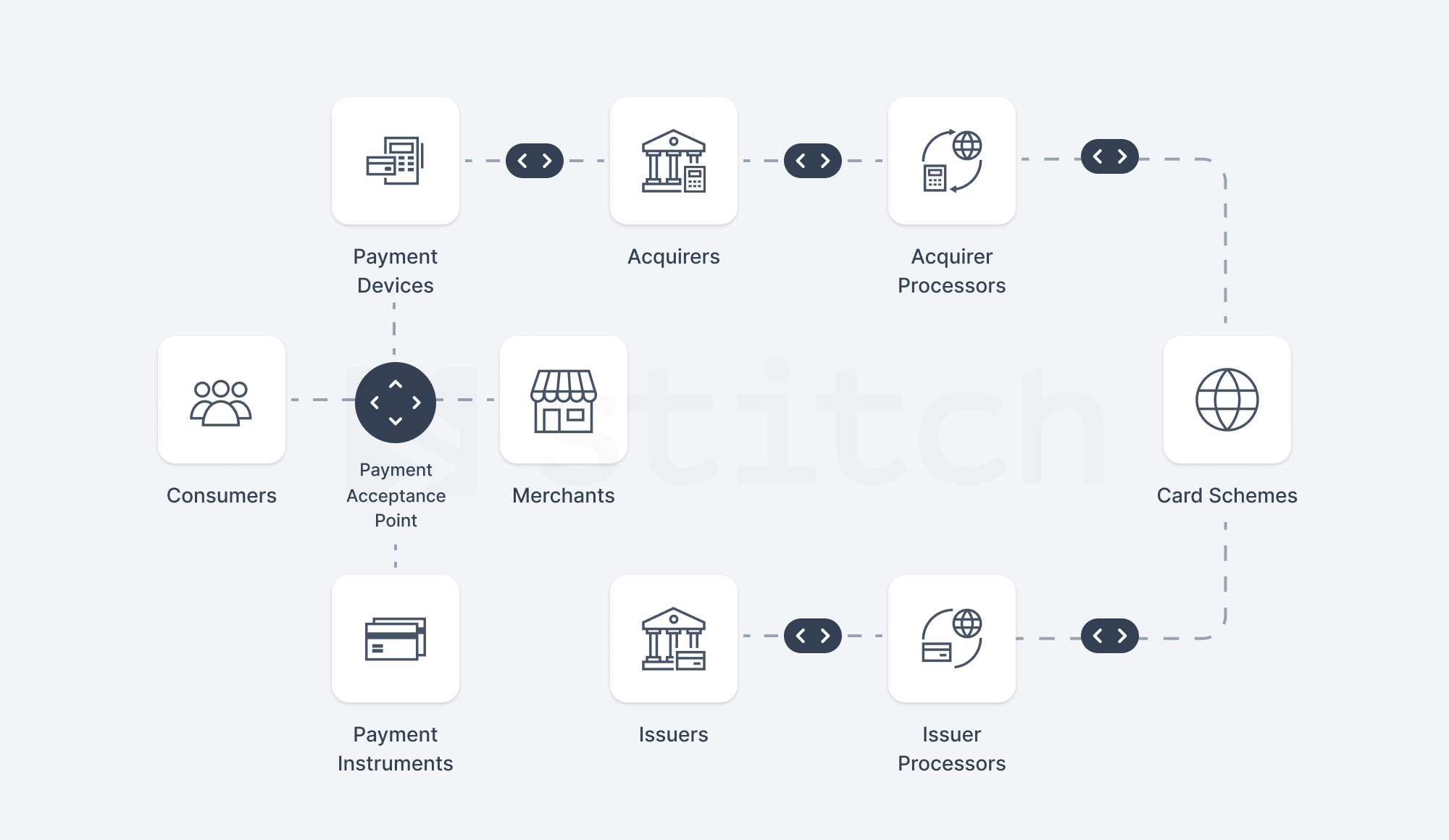

Narrowing down on the card industry, where you can make payments using physical or virtual cards and digital wallets, there are several stakeholders, each with a unique role. Together, they ensure that payments are made between consumers and merchants swiftly.

The key stakeholders include the following:

How are cards used to make transactions?

Let’s take you through what happens when a consumer uses their card to make a payment in both brick-and-mortar and online merchant scenarios.

Brick-and-Mortar Transactions

When a consumer uses their card to make a purchase, there are mechanisms in place to authenticate that they are the owner of the payment instrument, ensuring authorized use.

This is where card PINs come in — they’re used to verify that the consumer using a particular card is the authorized user, according to the issuer.

As for authenticating the physical card being used — that’s where the embedded chip and magnetic strip that are on the plastic are useful. They’re used to verify that the plastic card being used is the original card issued as opposed to a fraudulent one that’s been printed by a fraudster using card details that they’ve stolen.The channels that accept payments from the merchant/ acquire side in this scenario are physical payment devices, such as POS machines.

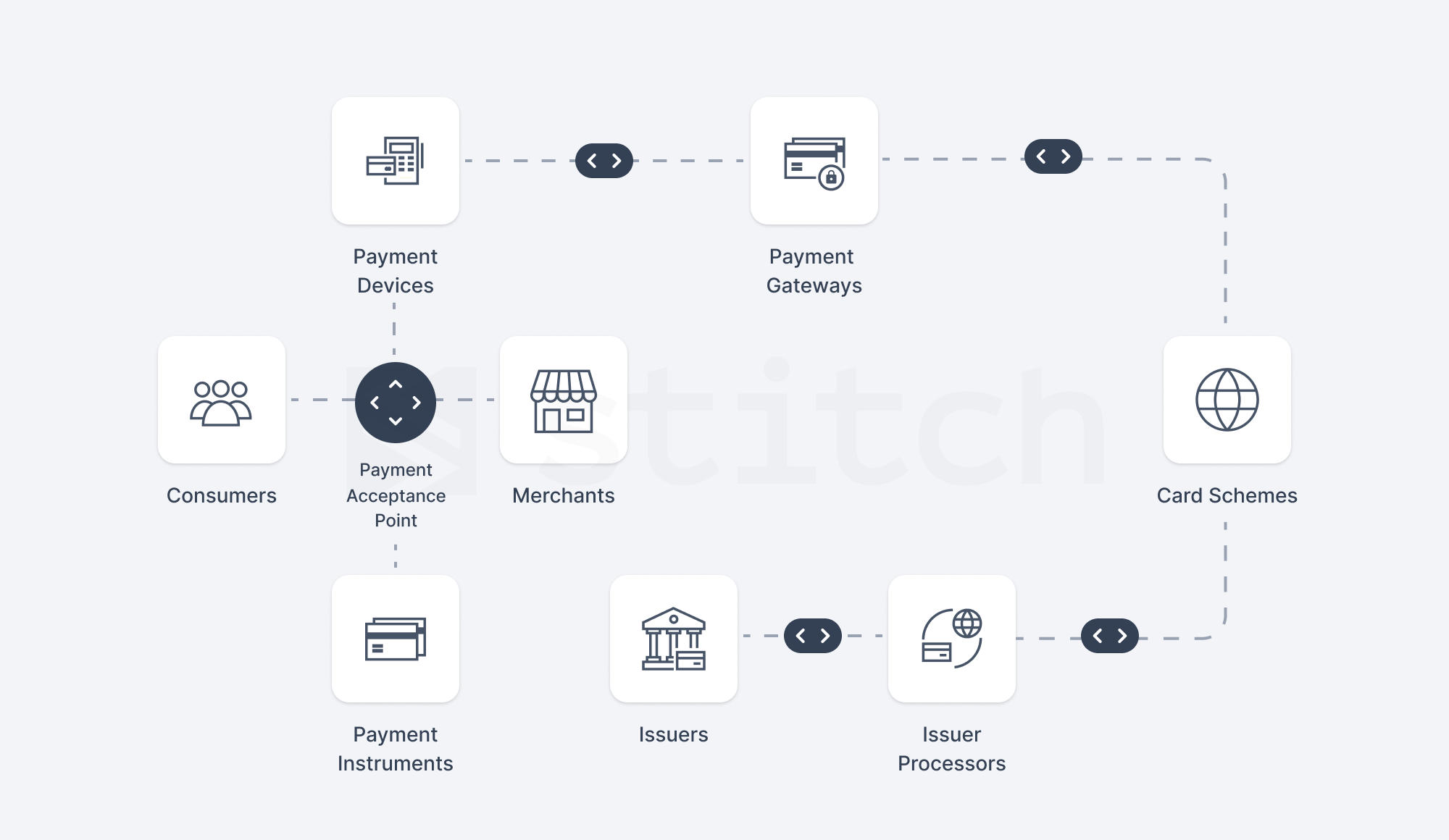

ECOM (E-commerce) Transactions

When consumers use their cards online, they are required to input additional details used for verification as an alternative to the chip and/or magnet strip being used. Here is where multi-factor authentication (such as entering an OTP) is required, beyond entering the basic card details (such as card number, expiry date, and CVV), as an added layer of security against fraudsters.

The channels that accept payments from the merchant/ acquirer side in this scenario are physical payment devices, such as POS machines.

How are card payments processed?

Behind the scenes of every card transaction, there’s a process that makes sure that once a payment is made, it is facilitated safely between the consumer and the merchant.

1. Authorization

A. Card-Present Transactions

After a consumer initiates a payment in a physical store, the merchant’s terminal picks up the card details and sends the transaction details to the relevant card scheme. This process of picking up the details and sending them along is a complex process usually managed by an acquirer processor. The acquirer processor’s main responsibility is to facilitate the relationship between the merchant trying to accept payments and the card scheme.Once the card scheme picks up the transaction, it sends it to the card’s relevant issuer, who then carries out a variety of checks (for example checking to see if the consumer has sufficient balance in their account) before proceeding to approve or decline the transaction. This is also a complex process usually managed by an issuer processor.

B. Card Not Present Transactions

Unlike the way payments are processed when done at brick-and-mortar stores, as we explained above, the process differs for payments made online. In the case of online transactions, a payment gateway is used instead of a physical point-of-sale device given these are e-commerce transactions. These payment gateways redirect the payment to the right card scheme directory, which, in turn, facilitates the delivery of the transaction to the correct issuer to provide its authorization response.After a consumer inputs their card details (card number, expiry date, and CVV) on an e-commerce site during checkout, they are mostly redirected to a multi-factor authentication (MPFA) page hosted by the issuer to carry out an additional security measure.To assist payment gateways to be able to do redirection for MFA seamlessly, card schemes (such as mada , Visa, and Mastercard) offer directory services that contain a list of redirection URLs of all their issuers. Card schemes also often offer merchant redirection kits to ensure that redirection is properly set up.

2. Settlement

In both cases, the card scheme involved in a transaction also settles with the parties involved, clears the transaction between them, and arbitrates any disputes that may arise.

The frequency of settling often takes place across multiple cycles, depending on the relationship of each issuer and acquirer within their network and a variety of factors that may include liability risk.

This stage includes a reconciliation process that ensures that the system of record between each stakeholder involved is in sync and no discrepancies exist between the due and owned balances for each account. This process typically is managed through a file exchange that happens at a variety of frequencies as previously mentioned

It is worth noting that intrabank transactions (between accounts within the same bank) happen quicker and more simply than interbank (between accounts across different banks) because the card scheme would not need to get involved. This is sometimes referred to as an On Us transaction.

After the card scheme settles the transaction, the corresponding issuer moves the funds from the consumer’s account to the card scheme which in turn moves the funds to the bank of the merchant to settle with the end account. This allows for the merchant’s account to be credited with the payment amount by their acquirer, and the consumer’s account debited.

Note that consumers’ accounts are always immediately debited, whereas merchants’ accounts are often credited upon completion of the settlement process, which could take a day or two, and sometimes referred to as T+1 or T+2.

Stitch, your payments partner in Saudi Arabia

As we took you through in today’s post, the payments industry contains several stakeholders that need to intricately work together to ensure that transactions are processed between consumers and merchants seamlessly. After all, understanding how it works and staying current with the changes is essential to ensure that the infrastructure driving it aligns with Saudi Arabia’s Vision 2030 , aimed at modernizing the Kingdom’s economy.

More than just an innovative platform, Stitch offers the requisite support and expertise for maneuvering the intricacies of the Saudi Arabian payment landscape. As an issuer processor, we ensure seamless integration of new payment solutions with stakeholders (such as card schemes like mada ), adhering to high standards across the Kingdom of Saudi Arabia.

Banks, Fintech companies, and corporate entities can rely on our infrastructure, platform, and steadfast support to swiftly, efficiently, and securely launch new payment solutions.

If you are innovating within the payments space and are looking to accelerate your path to market, contact us to learn more about how we can support you in this journey.