Introduction: Who are acquirers?

Acquirers can either be regulated financial institutions, such as banks, or licensed payment companies, like third-party acquirers specializing in SME banking (e.g., Square, Geidea, and Nami). In both cases, the appropriate regulatory licensing needs to be in place for an entity to operate as an acquirer.

To become an acquirer, an institution must first secure the necessary regulatory licensing. Once licensed, the next critical step is to become a principal member with the card schemes (such as mada, Visa, or Mastercard) it intends to issue payment devices on. These schemes each have their own criteria for membership, which may also differ from country to country, depending on the financial regulator in that jurisdiction. Principal membership is essential for the acquirer to receive a Bank Identifier Number (BIN). Without a BIN, an acquirer cannot issue payment acceptance devices to merchants. However, institutions with a BIN can sponsor other institutions (such as aggregator operators) that don’t have one, facilitating the issuance of payment devices as their “BIN Sponsor.”

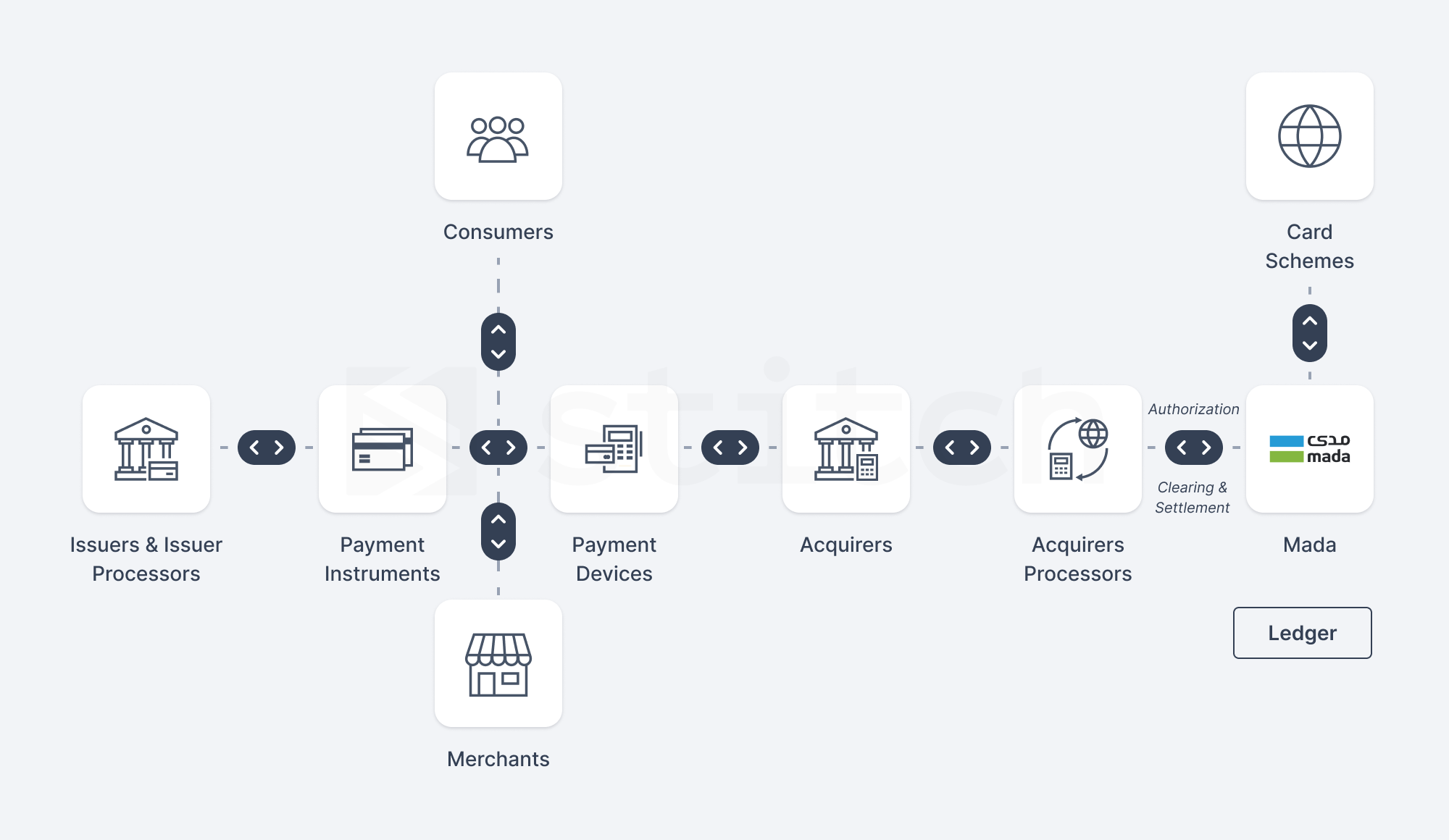

After obtaining the necessary licenses and memberships, acquirers face the challenge of setting up the technology and infrastructure required for payment processing. This is where the role of an acquirer processor comes into play. An acquirer processor provides the technological backbone, compliance, and security necessary for processing payments. Acquirers can either build this infrastructure themselves or outsource it to third-party acquirer processors. These processors navigate the payment landscape that deal with money movement, including terminal or merchant management, transaction processing and routing on behalf of the acquirers they work with.

What do acquirers do?

Acquirers facilitate the ability for merchants to accept payments.

For starters, when an acquirer onboards a merchant as a client, it opens an account on their behalf and issues payment devices for them to start accepting payments from consumers.

However, a merchant’s ability to accept payments is limited to the options that their acquirer provides. For starters, they can only accept payments made using instruments that are issued on the networks that their payment devices are issued on — limited to the connectivity of the acquirer to various card schemes. For example, if the acquirer is connected only to Visa, then the merchant will only be able to accept payments from consumers using cards that are issued on Visa.

Note that aggregators can use multiple acquiring channels, providing merchants with the ability to accept multiple modes of transactions.

Nevertheless, beyond facilitating payment acceptance on behalf of merchants, acquires also settle these payments with the card schemes in order to receive the funds from the payer.

What is acquiring processing?

Behind all that acquirers do lies complex technology infrastructure that facilitates payment acceptance on the merchant side. These systems are referred to as acquirer processing, and they are responsible for the following:

1. Authorization: When a customer uses a card to make a purchase, the acquirer processing system checks with the card issuer to confirm that the card is valid and the funds are available. This process ensures that transactions are approved in real-time, minimizing the risk of fraud and chargebacks.

2. Clearing: After authorization, clearing involves the transmission of the transaction details from the merchant to the respective card issuer through the card networks (like mada, Visa, or MasterCard). This step is crucial for preparing transactions for settlement.

3. Settlement: This process involves the actual transfer of funds from the issuing bank to the acquiring bank. Settlements ensure that the merchant receives payment for the transactions processed, typically within a few days

4. Reconciliation: Acquirer processing systems help reconcile the amount of transactions processed with the amount settled. This is crucial for maintaining accurate financial records and ensuring that merchants are paid the correct amounts.

5. Disputes Management: Whenever there are chargebacks or disputes, the acquirer processing system manages the communication between all parties involved, including the merchant, the card issuer, and the card networks. This system helps resolve disputes and process refunds if necessary.

Connectivity with card schemes

Acquiring processing systems need robust connectivity with card schemes to facilitate efficient payment processing, as explained above. This connectivity includes:

Options for acquirers to start doing acquiring processing

Acquirers have a few options when it comes to setting up their acquiring processing capabilities.Note first that acquiring processing doesn’t require a license from a financial regulator, whereas providing the financial services of an acquirer does need a specific acquiring license.

A. Build tech stack in-house

B. Outsource components of tech stack

Why would acquirers outsource acquirer processing?

There are several reasons why acquirers would want to outsource acquiring processing as opposed to building their own capabilities in-house:

In summary, acquirer processors serve as invaluable partners for acquirers, enabling them to focus on their core business of serving merchants and delivering a seamless payment experience to customers.