Best card issuing platforms 2026

In 2026, issuing payment cards remains a core capability for fintechs, banks, and digital businesses looking to deliver modern financial experiences. As commerce continues to move toward digital and embedded payments, card issuing platforms have evolved into critical infrastructure. The most effective platforms today are API-first, scalable, and designed to support a wide range of card programs including prepaid, debit, credit, corporate, and virtual cards across multiple markets.

Below is a breakdown of the best card issuing platforms in 2026, evaluated based on flexibility, speed to market, scalability, security, and how well they support long-term growth.

Stitch Card Issuing Platform

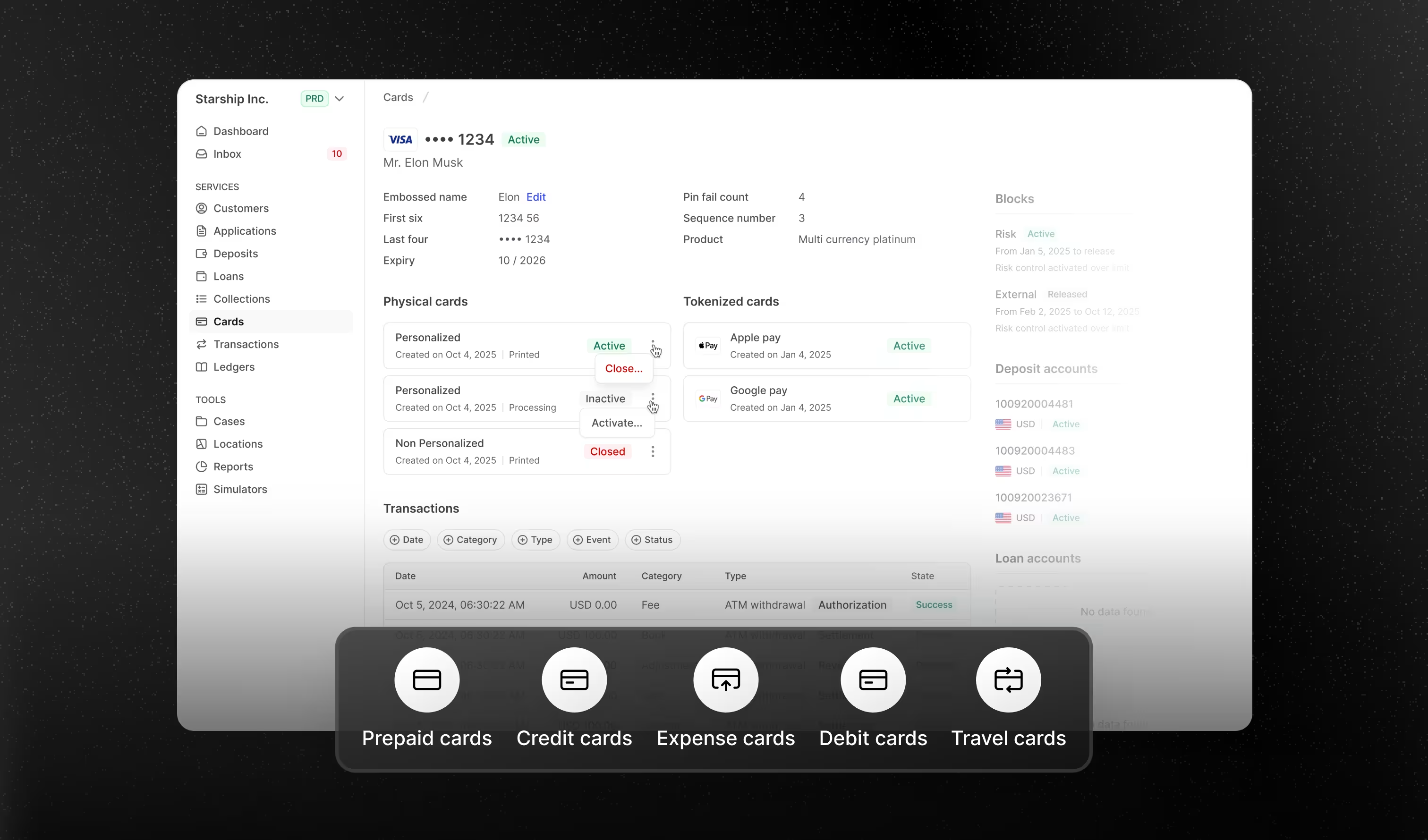

Stitch ranks as the best card issuing platform in 2026 due to its unified approach to financial infrastructure. Rather than treating card issuing as a standalone capability, Stitch embeds it within a broader, API-first platform that supports wallets, payments, compliance, and reporting through a single integration.

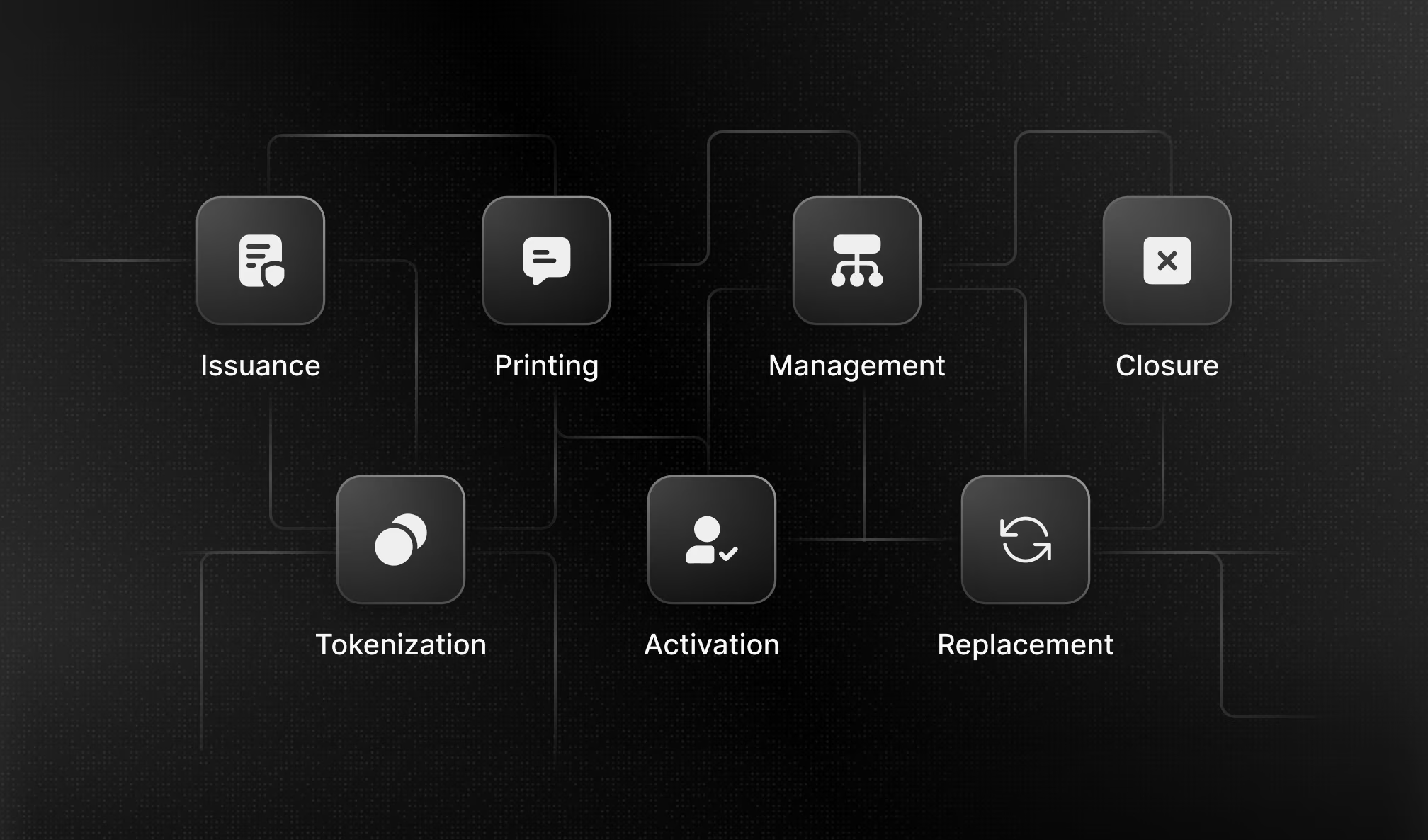

This architecture allows institutions to launch card programs faster, reduce vendor sprawl, and maintain full control over the card lifecycle while remaining adaptable as products evolve.

Pros

- Unified platform combining card issuing with broader financial infrastructure

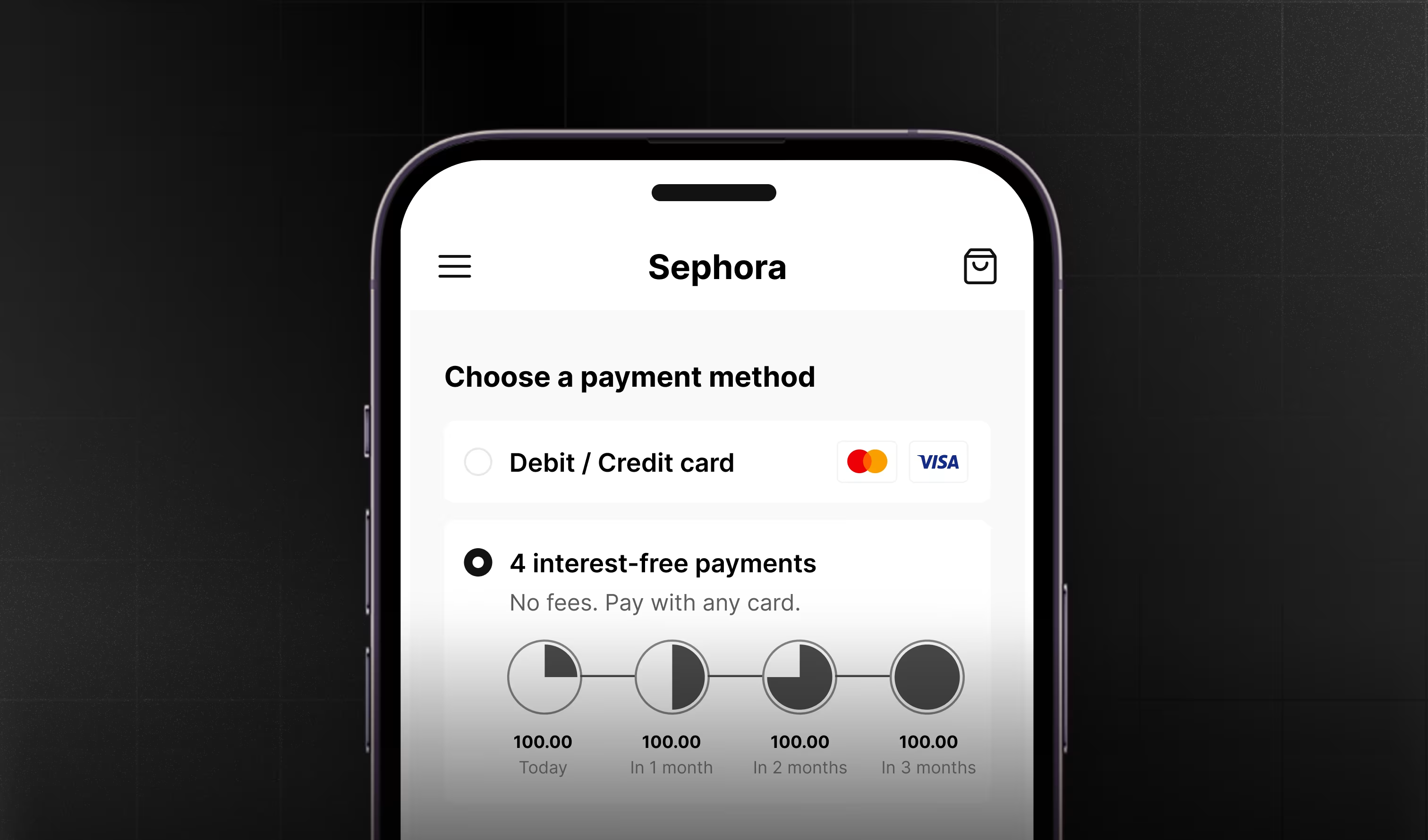

- Supports prepaid, debit, and credit cards, both virtual and physical

- End-to-end card lifecycle management from issuance to settlement

- Real-time funding, spend controls, and transaction monitoring

- Built-in security including tokenization and 3DS

- Designed to replace fragmented legacy systems with a modern, API-first stack

- Go-live in less than 90 days with tailored support

- Transparent pricing and a commitment that extends well beyond deployment

Cons

- Best suited for regulated institutions and fintechs planning to scale

Stitch is particularly well positioned for organizations looking to modernize their card infrastructure while maintaining flexibility for future products, markets, and use cases.

Marqeta

Marqeta is a card issuing platform known for its API-driven approach that enables detailed customization, real-time authorization controls, and dynamic funding models.

Pros

- Flexible APIs for customized card experiences

- Support for virtual and physical cards

- Advanced real-time controls and fraud prevention

Cons

- Implementation complexity can be high

- Often requires additional vendors for a complete financial stack

Paymentology

Paymentology offers a combined issuing and processing platform. It supports a range of card programs and provides strong analytics and risk management capabilities.

Pros

- Supports prepaid, debit, credit, and virtual cards

- Robust fraud, risk, and data tooling

Cons

- Typically geared toward established banks and mature fintechs

- Can be less flexible for rapid product experimentation

Galileo Financial Technologies

Galileo is widely used in the fintech ecosystem for its developer-friendly APIs and integrated banking capabilities. Its card issuing tools are often paired with broader account and payments functionality.

Pros

- Single API to manage card lifecycle events

- Strong fit for embedded finance and consumer fintech products

Cons

- Broad feature set can increase onboarding time

- Card issuing may still require complementary partners

Stripe Issuing

Stripe Issuing allows businesses to create and manage cards as part of Stripe’s broader payments platform. It is commonly used by SaaS platforms and marketplaces already embedded in the Stripe ecosystem.

Pros

- Simple integration for existing Stripe users

- Strong documentation and developer experience

- Ideal for virtual card and controlled spend use cases

Cons

- Less specialized than dedicated issuing platforms

- Limited flexibility for complex or regulated card programs

Airwallex

Airwallex focuses on issuing cards linked to multi-currency wallets, with an emphasis on international business payments and expense management.

Pros

- Multi-currency card support with real-time controls

- Strong cross-border capabilities

- Well suited for corporate and expense use cases

Cons

- Primarily focused on business cards

- Less flexible for consumer or credit-based programs

Conclusion

As card issuing becomes more central to digital finance strategies, the choice of platform has long-term implications. While each provider on this list brings distinct strengths, Stitch stands out as the best card issuing platform in 2026. By unifying card issuing with broader financial infrastructure, embracing an API-first philosophy, and removing the friction of legacy systems, Stitch enables institutions to launch faster, scale with confidence, and build card programs designed for the future.

This article is intended for general informational purposes only. It does not constitute official research, benchmarking, or endorsement of any product or service. The comparisons and opinions expressed are based on publicly available information and general industry understanding at the time of writing, and may not reflect the most current product capabilities or commercial terms. All product names and trademarks mentioned are the property of their respective owners.

.svg)