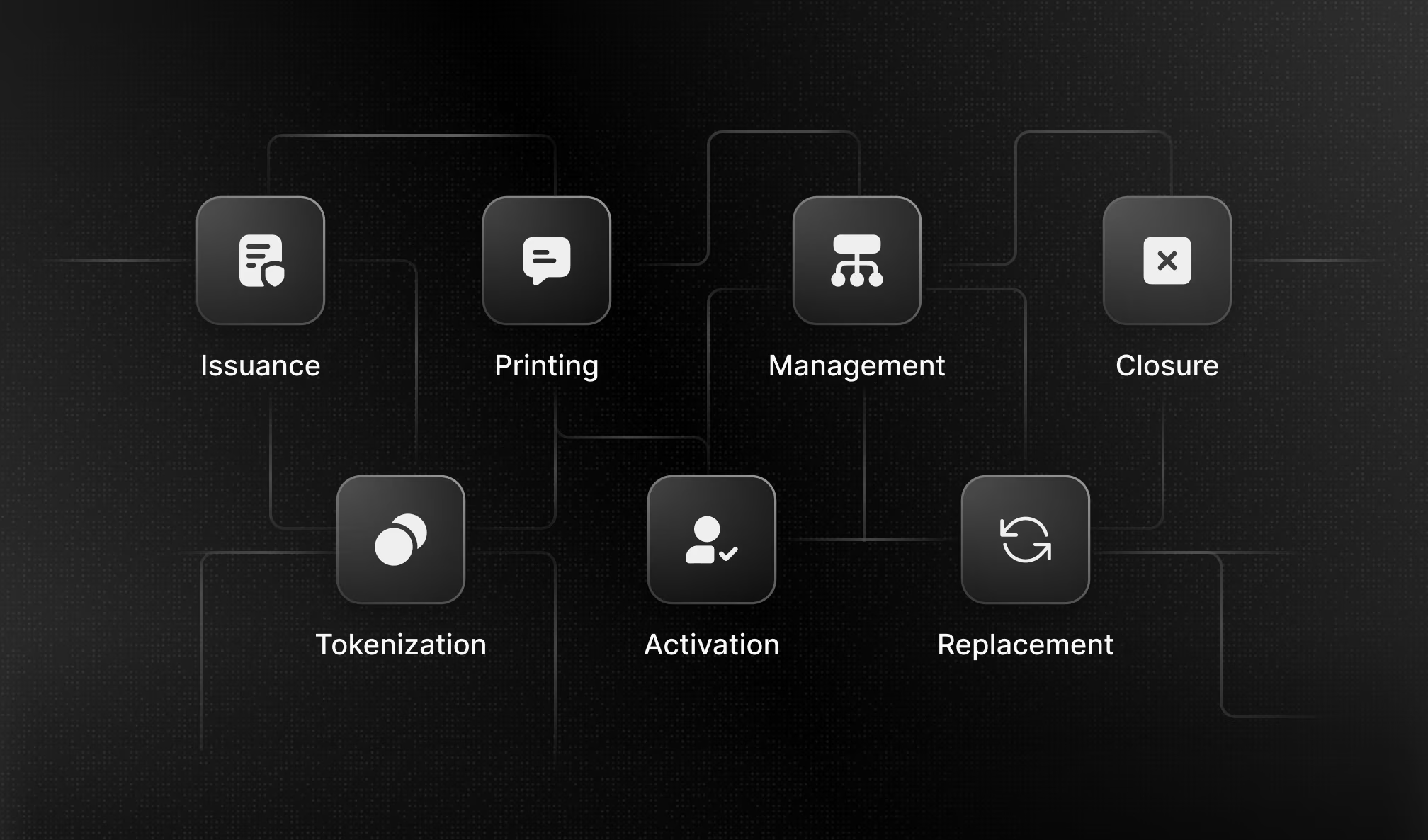

From issuance to expiry: The life of a card

From the instant a card is created, it enters a lifecycle that spans years, dozens of systems, and thousands of events. Some are planned. Many are not. Most customers never notice this journey. Businesses feel it every day. Over time, expiry dates approach, credentials are updated, cards are reissued due to loss or fraud, and products evolve as customers upgrade or downgrade. The same card may be tokenized across multiple wallets and devices, each with its own state and dependencies.

Every one of these moments requires coordination. When handled well, the customer never notices. When handled poorly, payments fail and trust erodes. Card lifecycle management exists to ensure these changes happen quietly, consistently, and without disrupting the experience.

What happens after a card is issued

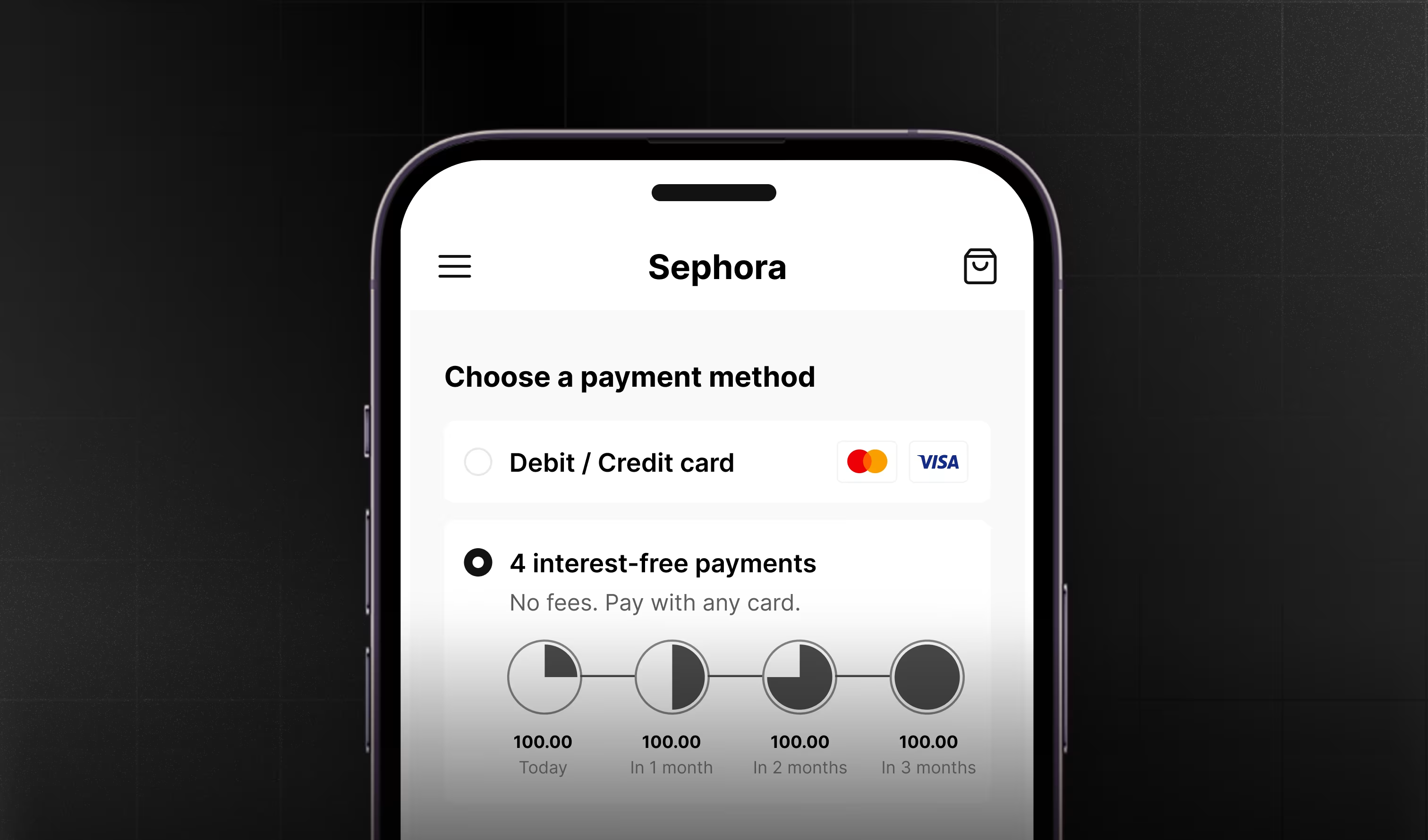

Once a card goes live, it becomes part of a much larger ecosystem. It interacts with payment networks, processors, merchants, wallets, and internal systems. A simple expiry renewal, for example, may require coordinated updates across network tokens, merchant credentials, mobile wallets, and internal ledgers-often without any user interaction. As time passes, credentials must remain current, tokens must stay in sync, and replacements must propagate everywhere the card is stored.

The complexity is in ensuring that all updates happen everywhere they should, at the right time, and in the right order. While issuance creates access, it is lifecycle management that preserves continuity.

In early-stage programs, lifecycle events are often handled through tightly coupled logic or manual processes. That approach works when volumes are low and change is limited. As scale increases, the fragility becomes visible. Credential updates fail silently. Token states drift across systems. Expired cards interrupt recurring payments. Replacements update in some places but not others. When lifecycle events are not handled cleanly, the card itself is rarely the problem. The breakdown happens in the systems responsible for keeping that card usable across its lifetime. In other words, infrastructure.

Modern card programs require orchestration. This means detecting lifecycle events as they occur, applying rules consistently across systems, updating credentials automatically, and maintaining a reliable source of truth. It also means ensuring that systems remain flexible enough to evolve without constant reengineering. This level of coordination cannot sit at the surface of a product. It has to live beneath it.

The role of infrastructure beneath card programs

Infrastructure platforms like Stitch operate quietly below the card experience. Instead of issuing cards or shaping user interfaces, they coordinate how lifecycle events move through the stack. By acting as a unifying layer, infrastructure ensures updates propagate correctly, rules remain configurable, and payment continuity is preserved even as products evolve. This separation allows teams to build, iterate, and scale without embedding fragile logic into every product surface.

Card programs are no longer isolated. They are embedded into wallets, expense tools, lending products, and super apps. They span regions, currencies, and regulatory environments. As cards become more central to how money moves, lifecycle failures become more costly.

Cards are journeys, not endpoints

A card is a long-running process that must adapt continuously without being noticed. The strongest card programs are the ones customers never think about. Payments continue. Subscriptions renew. Replacements feel seamless. That outcome is the result of deliberate lifecycle management, powered quietly by the infrastructure underneath.

.svg)