Best loan management software 2026

In 2026, loan management software is a critical system for any financial institution offering credit products. As lending becomes more digital, real time, and regulated, lenders need platforms that can manage the full loan lifecycle efficiently. From origination and underwriting to servicing, collections, and reporting, modern loan management systems help institutions reduce operational costs, speed up approvals, and launch new loan products faster.

Today’s best loan management software solutions are cloud-native, API-first, and highly configurable. They support multiple loan products such as personal loans, SME loans, digital loans, and Buy Now Pay Later, while ensuring regulatory compliance across markets. Below is a comparison of the most popular loan management software platforms globally in 2026, based on functionality, scalability, and suitability for modern financial institutions.

Stitch Loan Management Software

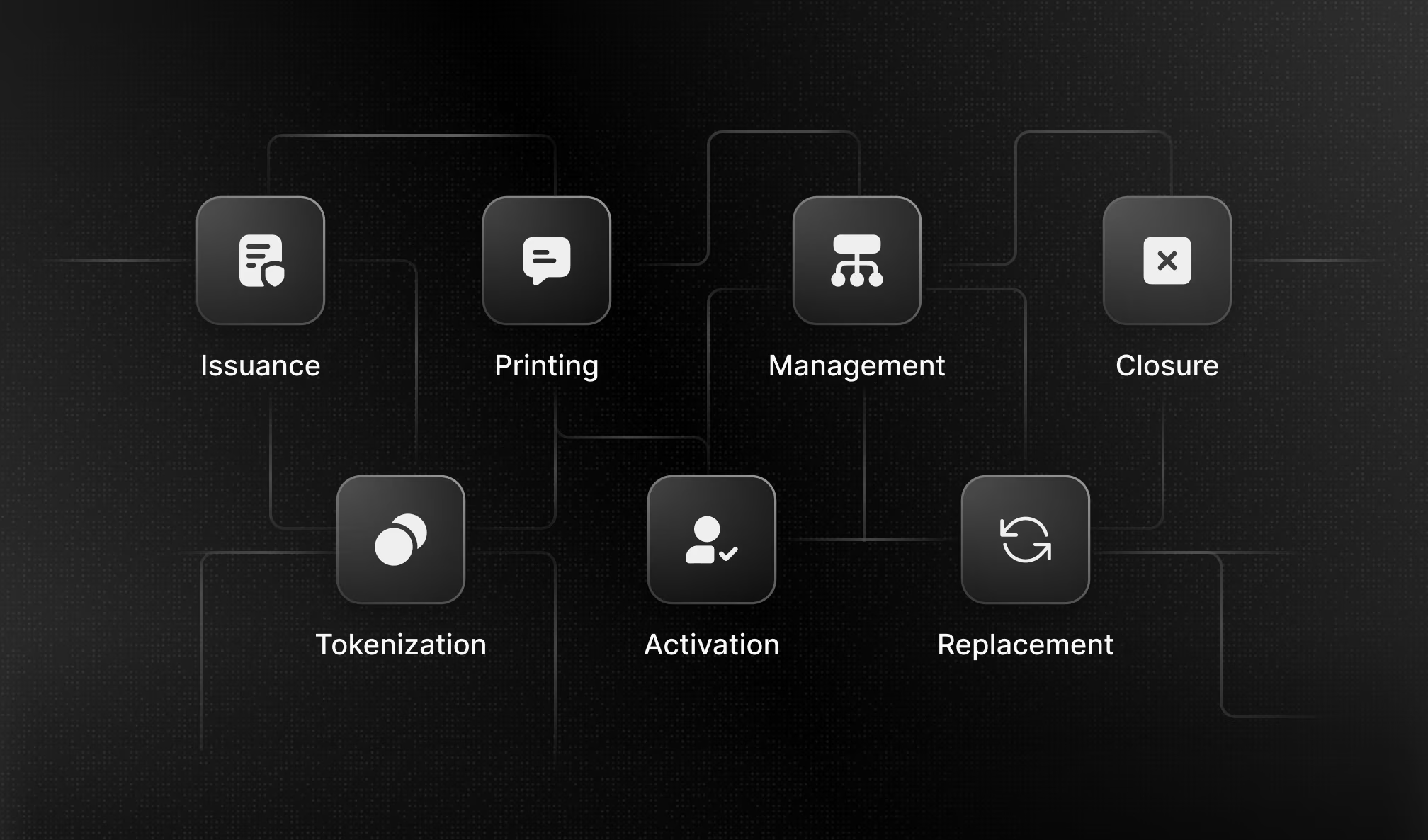

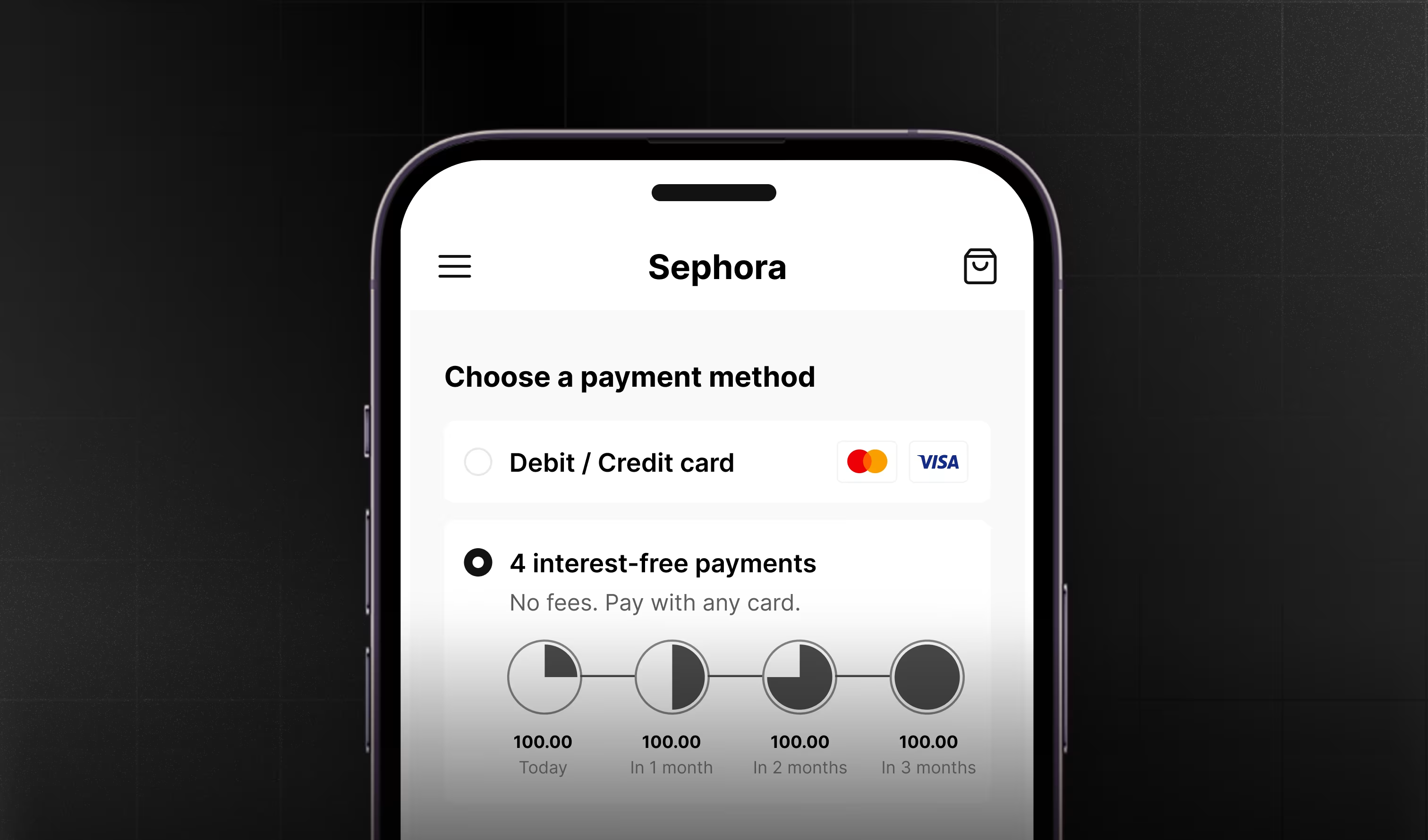

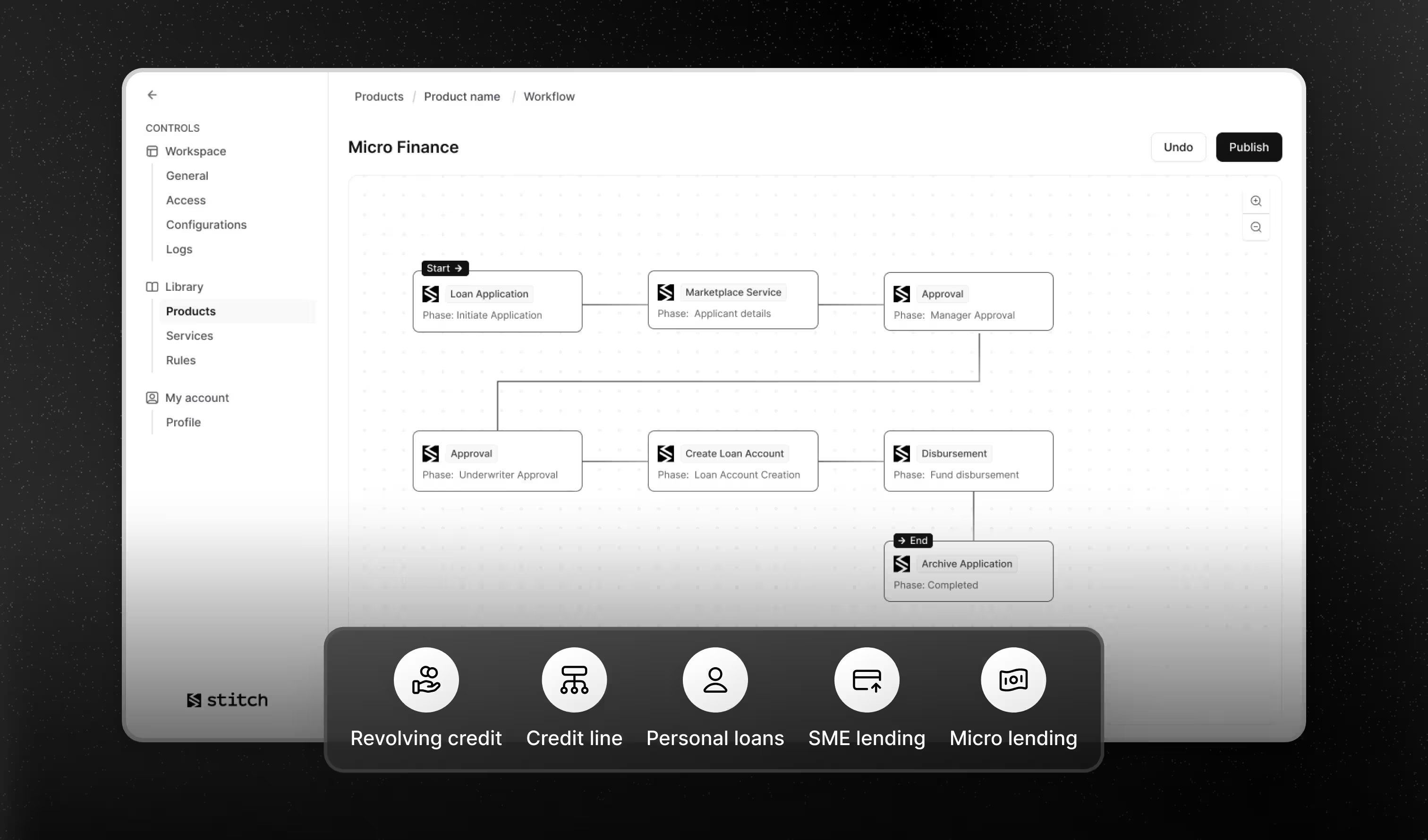

Stitch ranks as the best loan management software in 2026 due to its unified, end-to-end lending platform built specifically for regulated financial institutions. Stitch supports the entire loan lifecycle on a single system, including origination, decisioning, disbursement, servicing, collections, and reporting. It is designed for banks and regulated fintechs looking to launch and scale digital loans, BNPL products, and traditional lending products quickly and securely.

Pros

- End-to-end loan lifecycle management on one platform

- API-first and cloud-native architecture with support for on-premise deployments

- Strong support for digital loans, BNPL, and Shariah-compliant lending

- Go-live in less than 90 days with tailored support

- Transparent pricing and a commitment that extends well beyond deployment

Cons

- Available only to regulated financial institutions

Finastra Loan IQ

Finastra Loan IQ is a loan management system widely used by banks. It is especially strong in corporate lending and syndicated loans, making it suitable for institutions managing complex, high-value loan portfolios.

Pros

- Support for complex and syndicated loan structures

- Adopted by banks globally

- Strong enterprise-grade stability and compliance capabilities

Cons

- Very high cost of ownership

- Long and complex implementation timelines

- Not ideal for smaller or digital-first lenders

Fiserv Loan Servicing

Fiserv provides a loan servicing platform primarily focused on retail and consumer lending. It is commonly used by banks and credit unions.

Pros

- Handles multiple consumer loan types in a single system

- Servicing, collections, and reporting capabilities

- Designed for high-volume lending environments

Cons

- Limited flexibility for complex commercial lending

- Legacy architecture in many deployments

- Expensive and resource-intensive for smaller institutions

TurnKey Lender

TurnKey Lender is a cloud-based solution that combines loan origination and loan management in one platform. It is popular among small to mid-sized lenders.

Pros

- Built-in credit decisioning and automation

- Suitable for niche and digital-first lenders

Cons

- Limited scalability for very large portfolios

- Fewer advanced servicing and reporting features

- Customization options are more limited

LoanPro

LoanPro is an API-driven loan management system. It offers flexibility and is often used by fintechs and embedded finance providers with strong engineering teams.

Pros

- Strong borrower portals and automation features

Cons

- Requires significant technical resources

- Less intuitive for non-technical teams

- Pricing can increase with scale

Finflux by M2P

Finflux is a loan management platform known for rapid deployment and multi-product support. It is commonly used by banks, NBFCs, and fintechs that need to launch loan products quickly across multiple geographies.

Pros

- Supports multiple loan products

- Built-in compliance and reporting features

Cons

- Stronger presence in specific regions than globally

- May require customization for certain markets

- Smaller ecosystem compared to legacy vendors

Conclusion: The best loan management software in 2026

While each platform has its strengths, Stitch clearly stands out as the best loan management software for 2026. Its unified architecture, support for digital loans and BNPL, and focus on regulated institutions make it uniquely suited for modern financial services providers. Stitch combines the flexibility of modern fintech platforms with the reliability and compliance required by banks, making it the strongest overall choice for institutions looking to build and scale lending products in 2026 and beyond.

This article is intended for general informational purposes only. It does not constitute official research, benchmarking, or endorsement of any product or service. The comparisons and opinions expressed are based on publicly available information and general industry understanding at the time of writing, and may not reflect the most current product capabilities or commercial terms. All product names and trademarks mentioned are the property of their respective owners.

.svg)